On the third day of the Extraordinary Session, the House Revenue and Taxation Committee advanced HB1007. HB1007 reduces the top personal income tax rate from 4.7% to 4.4%. It reduces the corporate income tax rate from 5.1% to 4.8%. In addition, the bill provides an income tax credit of $150 to taxpayers making less than $90,000 annually. The credit would be retroactive to January 1, 2023.

The House State Agencies and Governmental Affairs Committee advanced HB1012. This bill amends the Freedom of Information Act of 1967 by exempting records that reflect the planning or provision of security provided to the Governor, constitutional officers, the General Assembly, Justices of the Supreme Court, or Judges of the Court of Appeals. The bill directs the Arkansas State Police to provide the legislature with a quarterly report on the expenses incurred by the Executive Protection Detail.

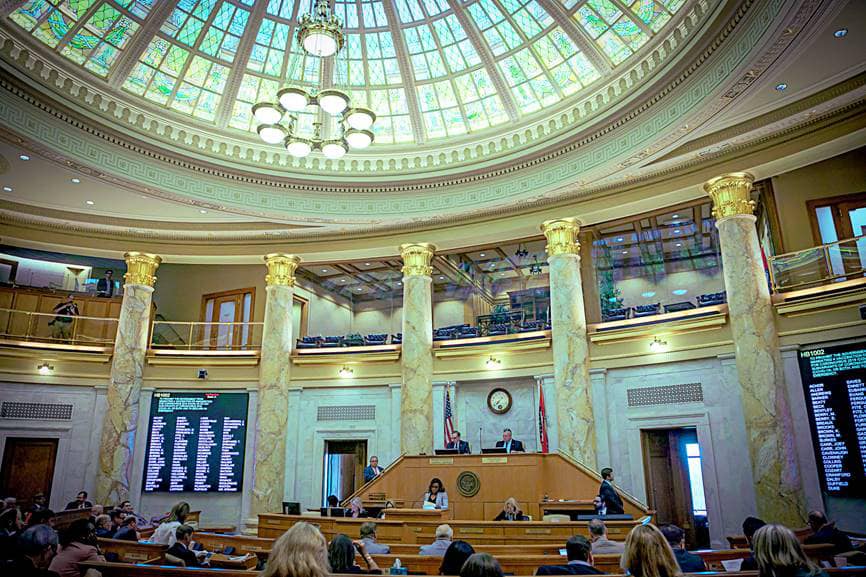

The full House passed HB1002. This bill states that a state agency, a political subdivision of the state, or a state or local official shall not mandate an individual to receive a vaccine or immunization for COVID-19 or any subvariants of COVID-19. It also states the Department of Health shall maintain information and data on any potential risks and harms associated with the administration of the vaccine or immunization for COVID-19 and any subvariants and shall make the information publicly available.

The House also passed HB1004. This bill would create the Arkansas Reserve Fund Set-Aside in the Restricted Reserve Fund and direct the transfer of $710.6 million in surplus funds to the newly created reserve fund. This bill would allow the transfer of funds from the Arkansas Reserve Fund Set-Aside to particular programs with the approval of 2/3 of the members of the Legislative Council or 2/3 of the members of the Joint Budget Committee if the General Assembly is in session.

The House will reconvene at 8:30 a.m. on Thursday.